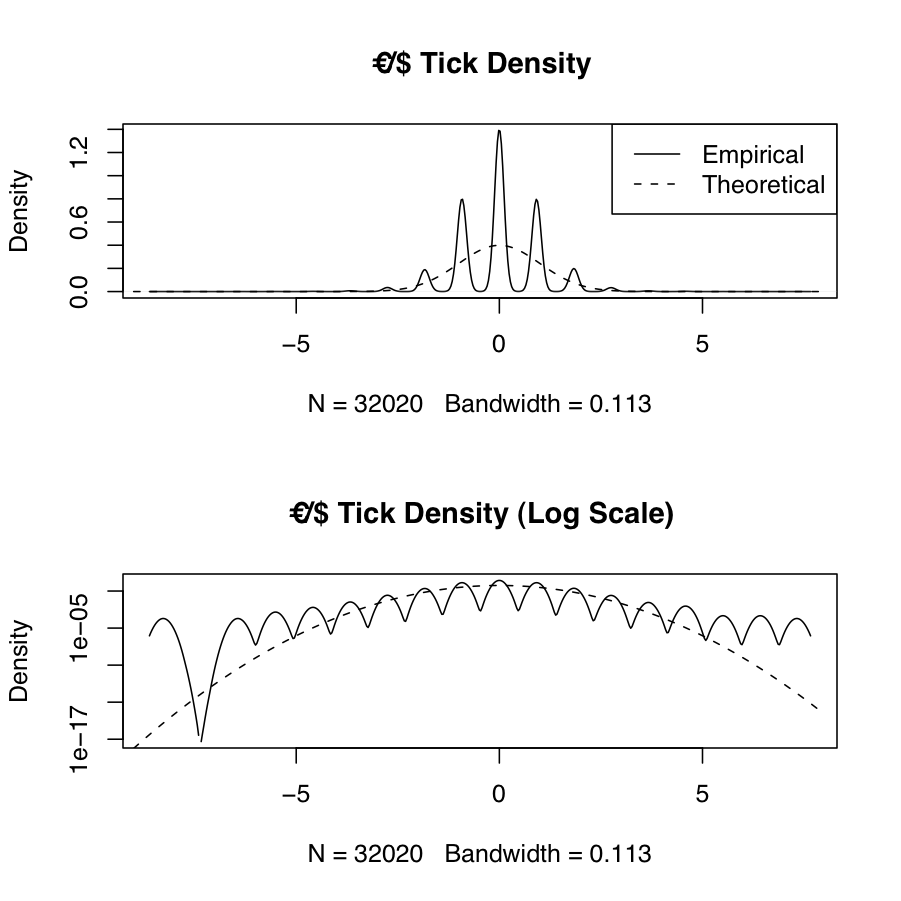

Frequently we will want to estimate the empirical probability density function of real-world data and compare it to the theoretical density from one or more probability distributions. The following example shows the empirical and theoretical normal density for EUR/USD high-frequency tick data

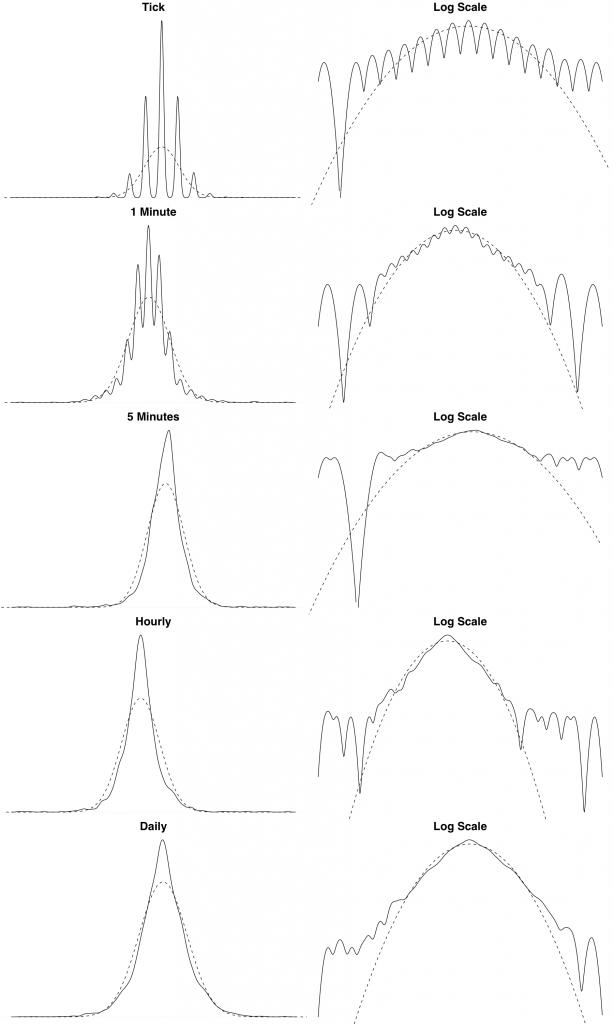

We also show the theoretical and empirical density for the EUR/USD exchange rate log returns over different timescales. We can see from these plots that the distribution of the log returns seems to be asymptotically converging to normality. This is a typical empirical property of financial data.

The following R source generates empirical and theoretical density plots across different timescales. The data is loaded from files that are sampled at different intervals. I cant supply the data unfortunately, but you should get the idea.

[source lang=”R”]

# Function that reads Reuters CSV tick data and converts Reuters dates

# Assumes format is Date,Tick

readRTD <- function(filename) {

tickData <- read.csv(file=filename, header=TRUE, col.names=c("Date","Tick"))

tickData

tickData

}

# Boilerplate function for Reuters FX tick data transformation and density plot

plot.reutersFXDensity <- function() {

filenames <- c("data/eur_usd_tick_26_10_2007.csv",

"data/eur_usd_1min_26_10_2007.csv",

"data/eur_usd_5min_26_10_2007.csv",

"data/eur_usd_hourly_26_10_2007.csv",

"data/eur_usd_daily_26_10_2007.csv")

labels <- c("Tick", "1 Minute", "5 Minutes", "Hourly", "Daily")

par(mfrow=c(length(filenames), 2),mar=c(0,0,2,0), cex.main=2)

tickData <- c()

i <- 1

for (filename in filenames) {

tickData[[i]] <- readRTD(filename)

# Transform: `

logtick <- diff(log(tickData[[i]]

x <- seq(floor(min(logtick)), ceiling(max(logtick)), .01)

plot(density(logtick), xlab="", ylab="", axes=FALSE, main=labels[i])

lines(x,dnorm(x), lty=2)

#legend("topleft", legend=c("Empirical","Theoretical"), lty=c(1,2))

plot(density(logtick), log="y", xlab="", ylab="", axes=FALSE, main="Log Scale")

lines(x,dnorm(x), lty=2)

i <- i + 1

}

par(op)

}

[/source]